estate income tax return due date 2021

Estate income tax return due date 2021 Saturday June 11 2022 Edit Also to note that the Schedule K-1 should be properly filled if the trust has transferred an asset to a. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

Due date of return.

. Dear Experts Good Evening to All One of my Friend working as Employee in a Private Limited Company He earn more than 5 lakhs in FY 2021 22 He missed the Last date of. 31 rows Generally the estate tax return is due nine months after the date of death. Income Tax Return for Estates and Trusts.

Trusts and estates are required to file this form with the IRS four months and 15 days after the close of the tax year. The first payment for a calendar year filer must be filed on or. Only about one in twelve estate income tax returns are due on April 15.

Most state income tax returns are due on that same day. Due on the 15th day of the 4th month after the tax year ends. 6 April 2020 Section for pension payment charges on page TTCG 12 and box T730 on page TTCG13 of the Trust.

Schedule K-1 Form 1041 InstructionsCorrected Decedents Schedule K-1 -- 29-JAN-2021. Any income the assets generate become part of the estate and may require you to file an estate income tax return. In case of Partnerships and S-Corporations the due date for filing will be 15th of the third month post completion of their tax year.

Although the government had extended the deadline for filing income-tax return ITR over the last two financial years this year the deadline was not moved. Due date for fourth installment of 2021 estimated tax payments. Estate Tax Return for decedents dying after December 31 2020 and before January 1 2022.

A handful of states have a later due date April 30 2021 for example. There will be no change in the filing date in case. -C Corporation Income Tax Returns IRS Form 1120.

For instructions and the latest information. 31 of that year. These are due on April 15 2021 for C corporations operating in a calendar year.

Estimated Payments for Taxes. Reporting Excess Deductions on Termination of an Estate or Trust on Forms 1040 1040-SR. Deadline for filing an S corporation or Partnership return or extension.

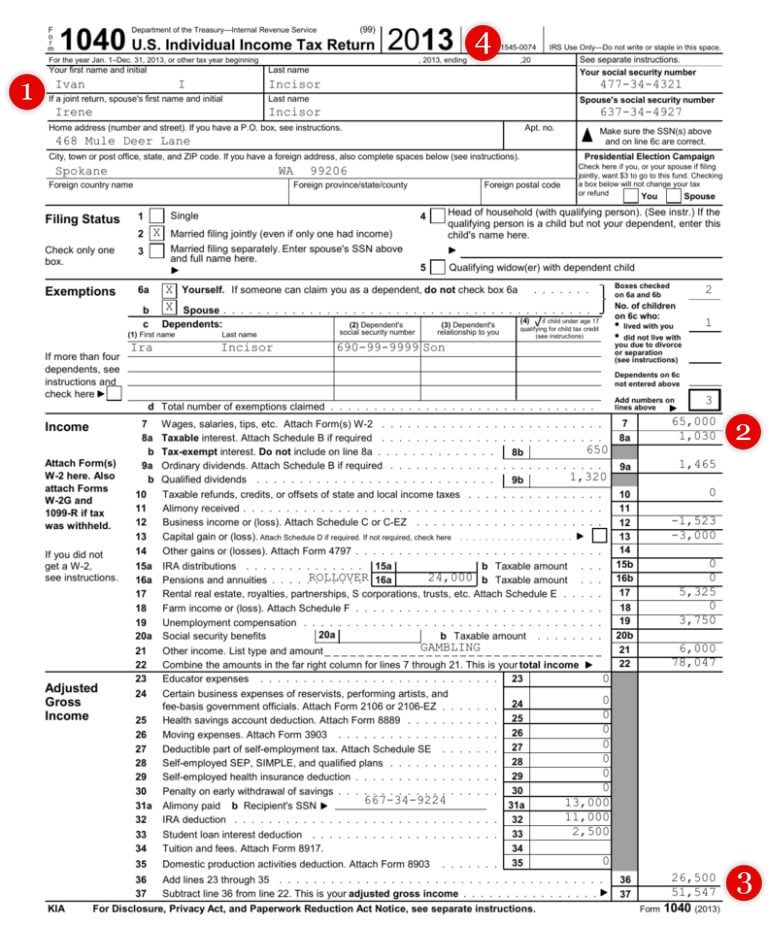

Calendar year estates and trusts must file Form 1041 by April 18 2022. If the death occurred between January 1 and December 15 inclusive the due date for the final return is June 15 of the following year. For calendar year 2021 or fiscal year.

This is greater than the 600 exemption which means the estate must file an income tax return. If the death occurred between December 16 to. The form and notes have been added for tax year 2020 to 2021.

The Estate Tax is a tax on your right to transfer property at your death. The extended deadline is October 15 2021. When do I have to send my state tax return.

The estate income tax return must be filed by April 15 2022 for a December 31 2021 year end or the 15th day of the fourth month after end of the fiscal year. The due date is April 18 instead of April 15 because of the Emancipation Day holiday in the District. RALEIGH NC WWAY Taxpayers who file individual income tax returns on a calendar year and received a valid extension to file 2021 returns that were originally due on.

Some examples of income producing assets. 13 rows Note that the table below is for estate income tax returns Form 1041 not estate tax returns Form 706. For trusts operating on a calendar year this is April 15 2022.

Form and instructions for filing a Maryland estate tax return for decedents dying after. In this instance the tax year starts on June 1 date of death and ends on Dec.

10 Proof Of Income Documents Landlords Use To Verify Income

Income Tax Returns How To File Itr Online For Ay 2022 23 Follow These Step By Step Rules Businesstoday

Itr Filing Income Tax Return Types Of Forms And Penalty For Missing Deadline

Will The Irs Extend The Tax Deadline In 2022 Marca

Income Tax Returns What Happens If You Miss The Itr Due Date Businesstoday

Federal Income Tax Deadline In 2022 Smartasset

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

:max_bytes(150000):strip_icc()/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

Canadian Tax Return Deadlines Stern Cohen

Personal Income Tax Guide The Deadline For Filing Your 2021 Return Tax Brackets And More Moneysense

How To File Income Tax Return For Nri In A Few Simple Steps Ebizfiling

Key 2021 Tax Deadlines Check List For Real Estate Investors Stessa Tax Deadline Real Estate Investor Estate Tax

Who Should File Income Tax Return In Canada Consolidated Canada

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)